Which Best Describes Two Common Types of Receivables

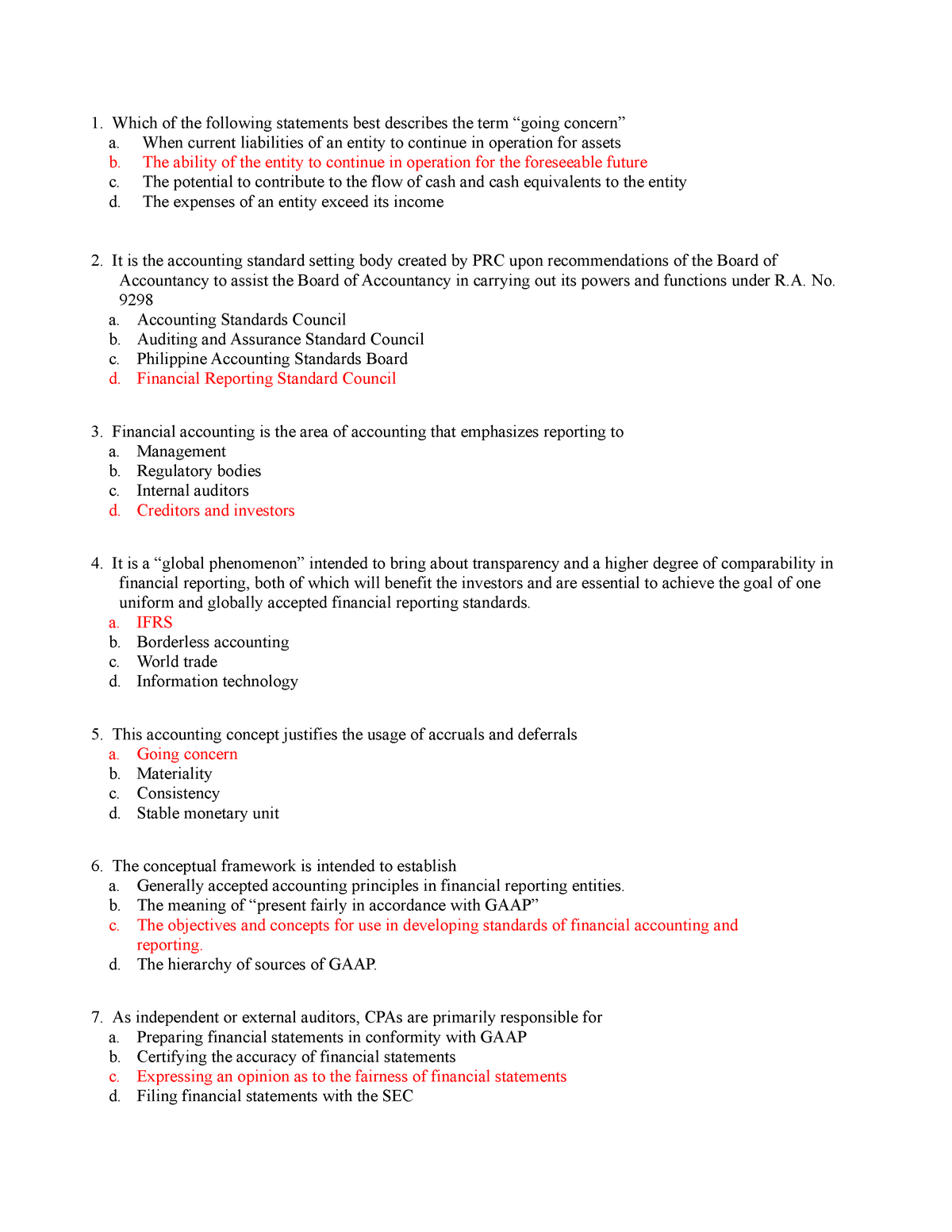

Accounts receivable are amounts customers owe on an account whereas notes receivable are written promises for amounts to be received. A What are the three different types of receivables and how should they be classified on the balance sheet.

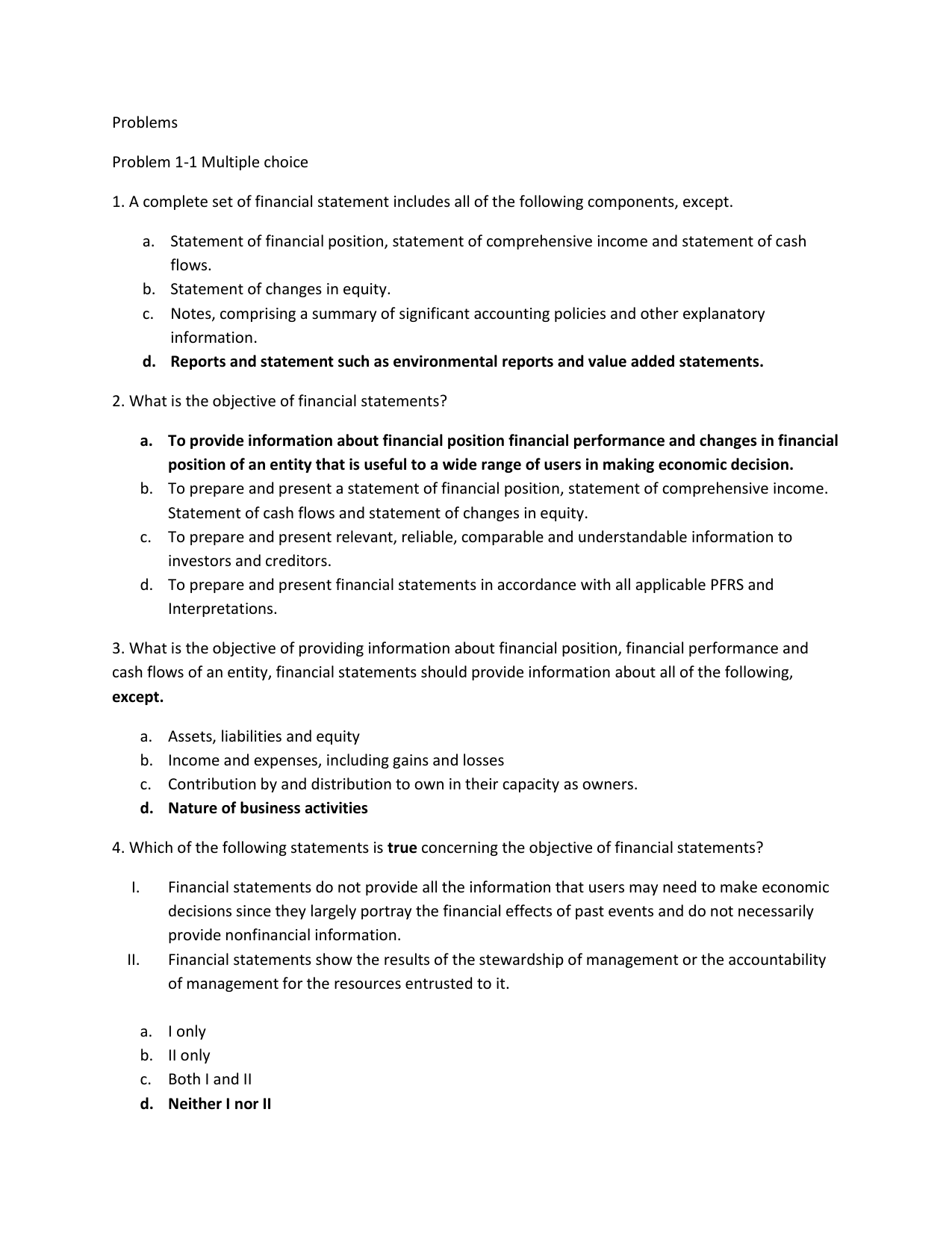

1 Which One Of The Following Best Describes The Purpose Of The Balance Sheet A A Financial Statement Showing The Assets Liabilities And Net Worth Of Ppt Download

Accounts receivable is the sum of money customers owe the firm for normal purchases on credit.

. Common Methodology is the term that best describes a cycle of exercises of varying types aligned to a common set of program objectives. They are considered to be a current asset since they are collected within a period of two months after the sale. Since it is an outright sale of receivables the borrower is.

8Which of the following is a Medium Complexity exercise. Carl Warren James M. List three situations that would indicate that an account may be uncollectible.

The right to receive cash in the future from customers from goods sold or for services performed B2. Accounts receivables with credit balances. 1 Introduction To Accounting And Business 2 Analyzing Transactions 3 The Adjusting Process 4 Completing The Accounting Cycle 5 Accounting Systems 6 Accounting For Merchandising Businesses 7 Inventories 8 Internal Control And Cash.

Describe the common classes of receivables. What are the types of account receivable. Credit is directly given to.

They appear below the short-term investments on the balance sheet. Accounts Receivable aka trade receivables amount that another party owes a company from credit sales. Traditional Factoring In this financial product a company would receive approximately 80 of the face value of its invoices upfront while the lender takes ownership of those invoices and pursues collection.

On the other hand notes receivable are the sums of money. Under the factoring approach the borrower sells its receivables to a factoring institution. Common types of receivables We use cookies to ensure that we give you the best experience on our website.

Other receivables arise from nonbusiness and nontrade transactions. There are two types of accounts that an organization maintains in its books of accounts. Accounts that have been outstanding for a long time.

Factoring is the most common form of accounts receivable financing for smaller businesses. 2 most common types of receivables are accounts receivables and note receivables. Up to 24 cash back uncollectible receivables.

The receivables are sold at a discount where the discount depends on the quality of the receivables. There are three basic types of Accounts Receivable financing that you might consider taking advantage of in order to obtain upfront cash. Accounts receivable arise from businesstrade transactions.

What are accounts receivables. Answer the following question Learning Objective 1. Within the Discussion Board area write up to 300-400 words that respond to the following questions with your thoughts ideas and comments.

Select one or more. The date when a note is due B3. Describe the accounting for uncollectible receivables.

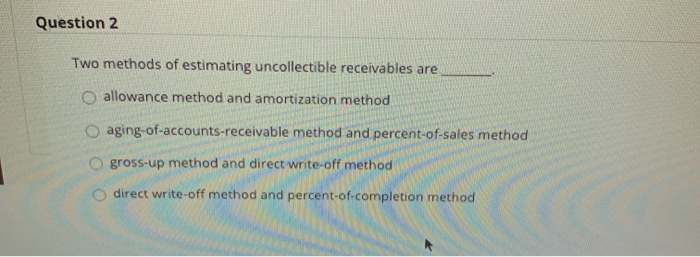

Notes receivable arise from written promises to pay a specified amount at a specified time. What are the two methods of accounting for uncollectible receivables when does each method record the related bad debt expense and which types of companies use each of the different methods. A What are the two methods of accounting for uncollectible.

Define and explain two common types of receivables. Receivables from related parties. Answer of Explaining common types of receivables and designing internal controls for receivables Organizational Kings performs organizational consulting.

A written promise that a customer will pay a fixed amount of principal plus interest by a certain date in the future B2i. This will be the foundation for future discussions by your classmates. A transaction assertion is a temporary account that is not transferred to next year but is closed in the current financial year such as sales cost of sales and expenses etc.

Non-Current Receivables receivables that are collectible exceed the agreed time at the beginning so that the seller is harmed by the incident. Which of the following types of receivables would not deserve the special attention of the auditor. What are some common types of receivables other than accounts receivable and notes.

7Which term best describes a cycle of exercise of varying types aligned to a common set of program objectives. Accounts receivable notes receivable and other receivables are classified as receivables. Which best describes two common types of receivables.

Current Receivables the definition of receivables that are collectible in accordance with the agreement at the beginning. Be substantive and clear and use examples to reinforce your. Which of the following receivables would most likely be reported separately in a firms financial statements and why.

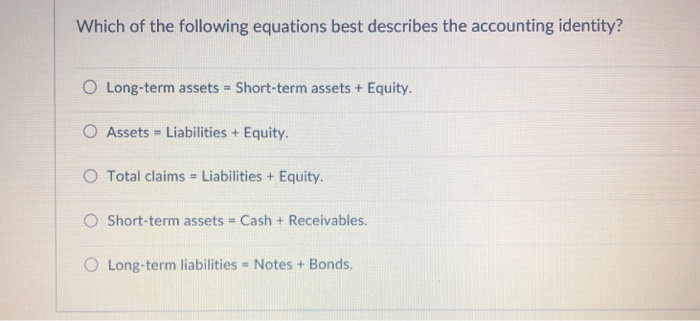

Solved Which Of The Following Equations Best Describes The Chegg Com

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

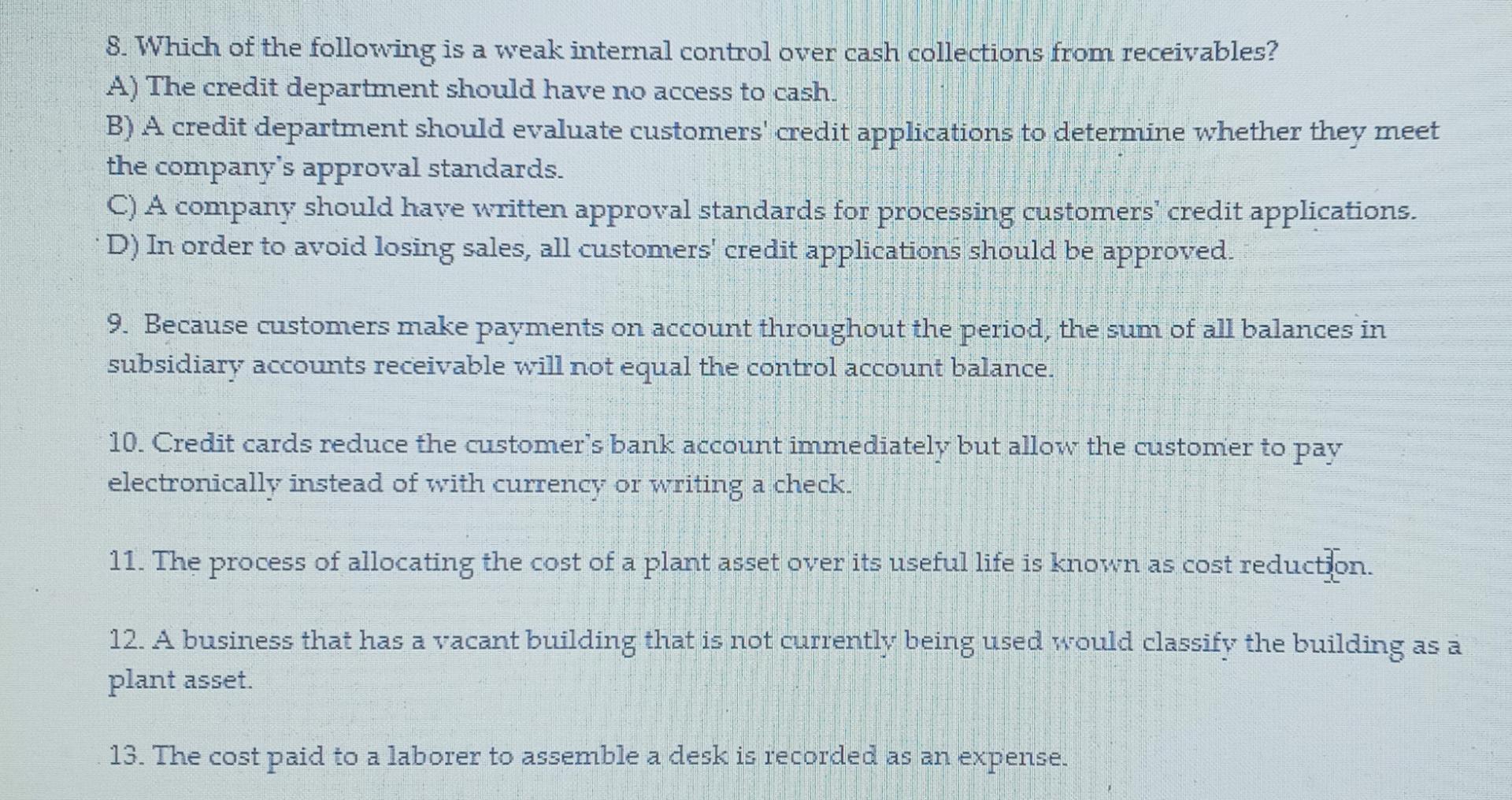

Ch 8 Questions Flashcards Quizlet

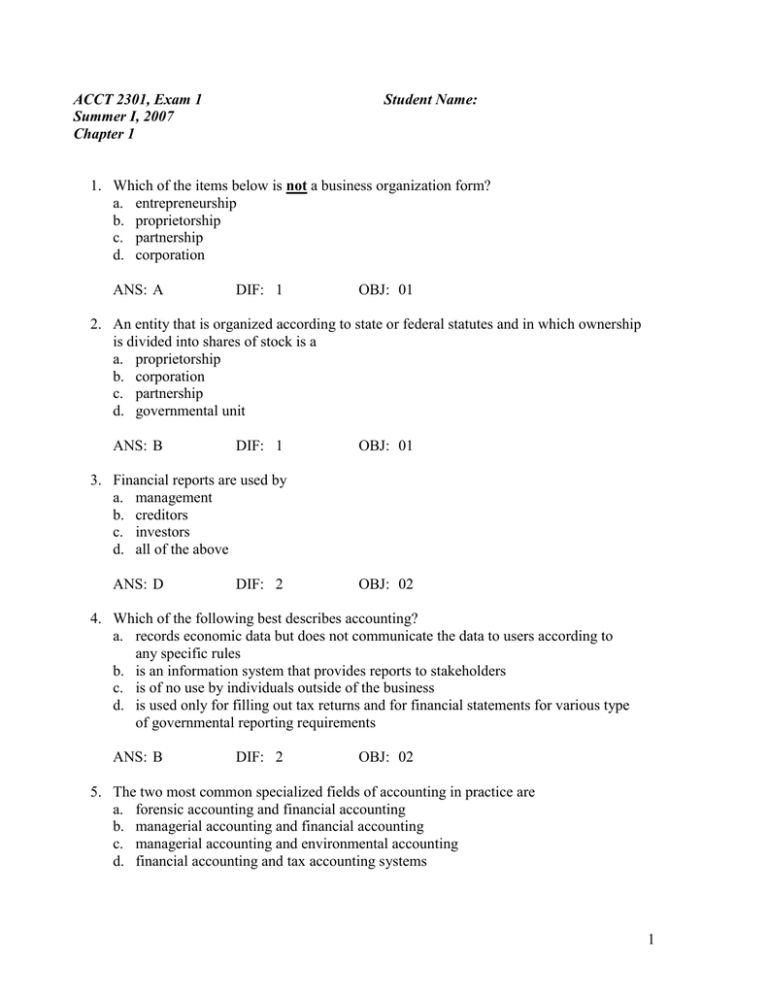

Mgcr 211 Financial Accounting Quiz 1 Chapters 1 3

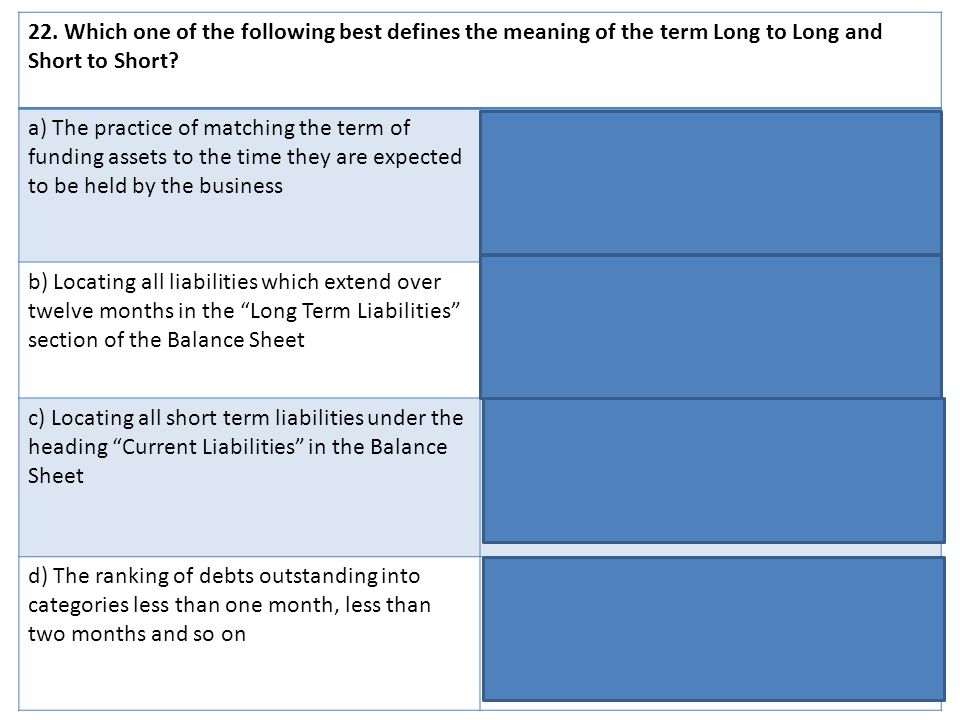

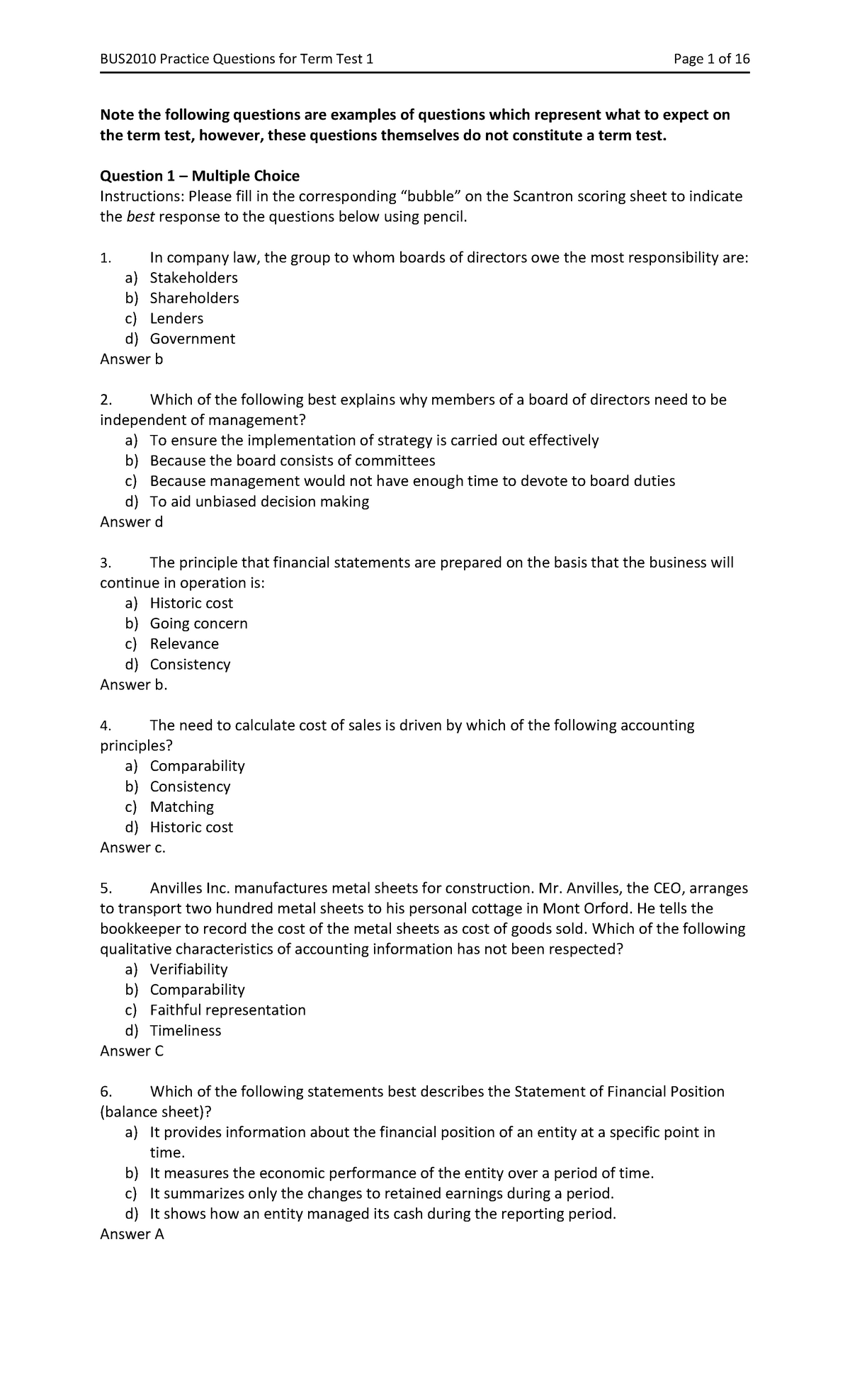

Test 1 28 March 2018 Questions And Answers Bus 2010 Fundamentals Studocu

Projects Are Also Often Embedded With Different Options That Can Help Making Decisions Under Uncertainty There Homeworklib

Ch 8 Questions Flashcards Quizlet

Atu Quickbooks Flashcards Quizlet

Solved 1 The Two Major Types Of Receivables Are Interest Chegg Com

Which Of The Following Statement S Best Describe The Main Difference Between Maltose And Cellobiose O A Homeworklib

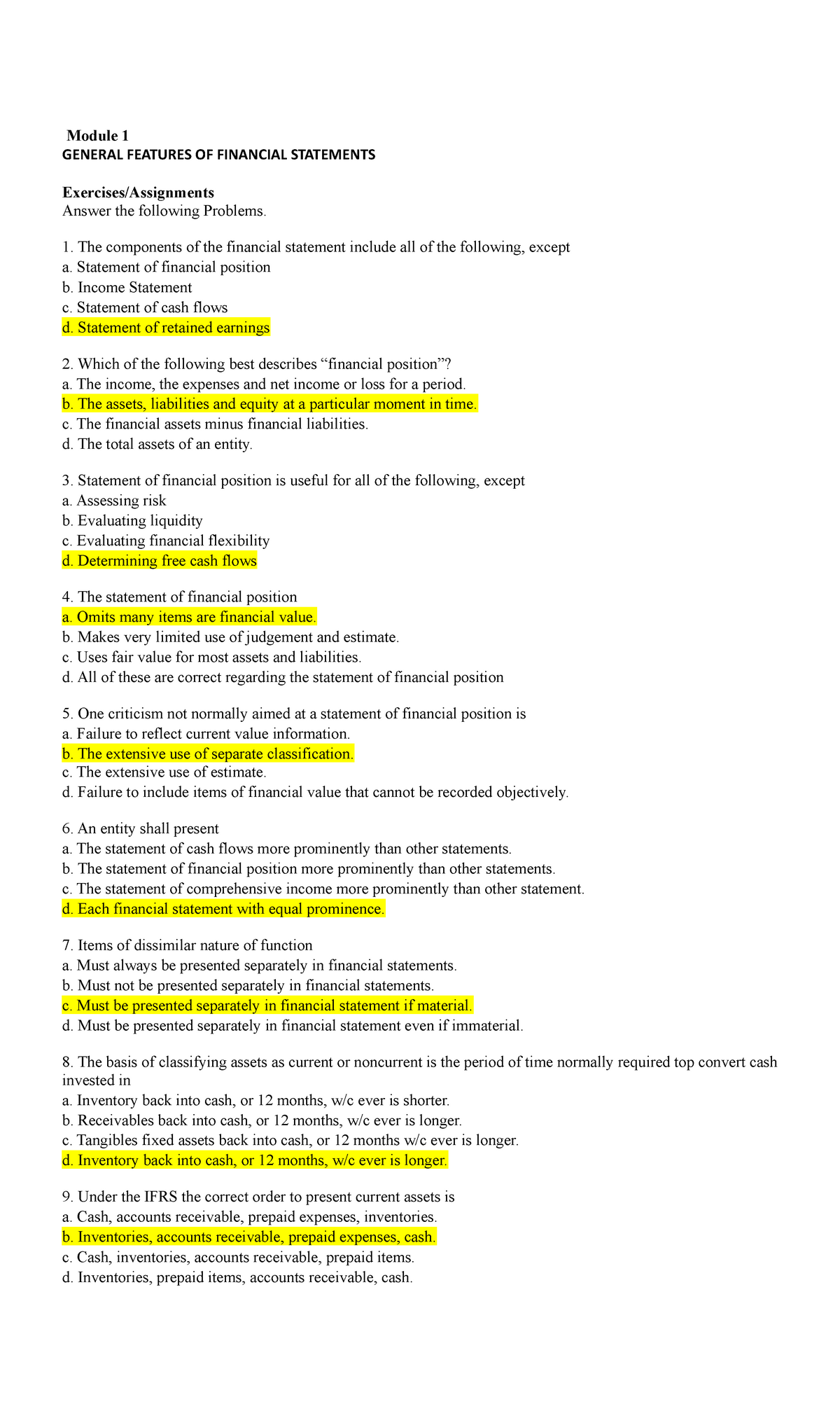

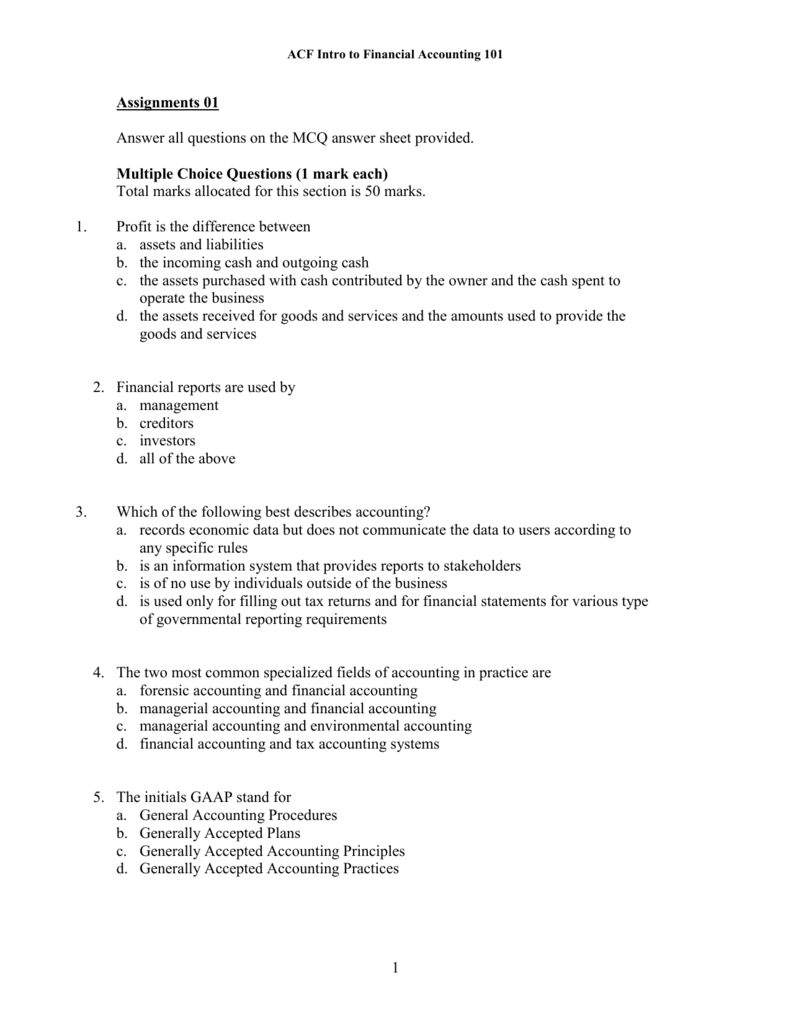

In Acc 1 In Acc Module 1 General Features Of Financial Statements Exercises Assignments Answer Studocu

Solved Question 1 6 5 Poir For A Company With Significant Chegg Com

Solved Question 1 6 5 Poir For A Company With Significant Chegg Com

1 Which One Of The Following Best Describes The Purpose Of The Balance Sheet A A Financial Statement Showing The Assets Liabilities And Net Worth Of Ppt Download

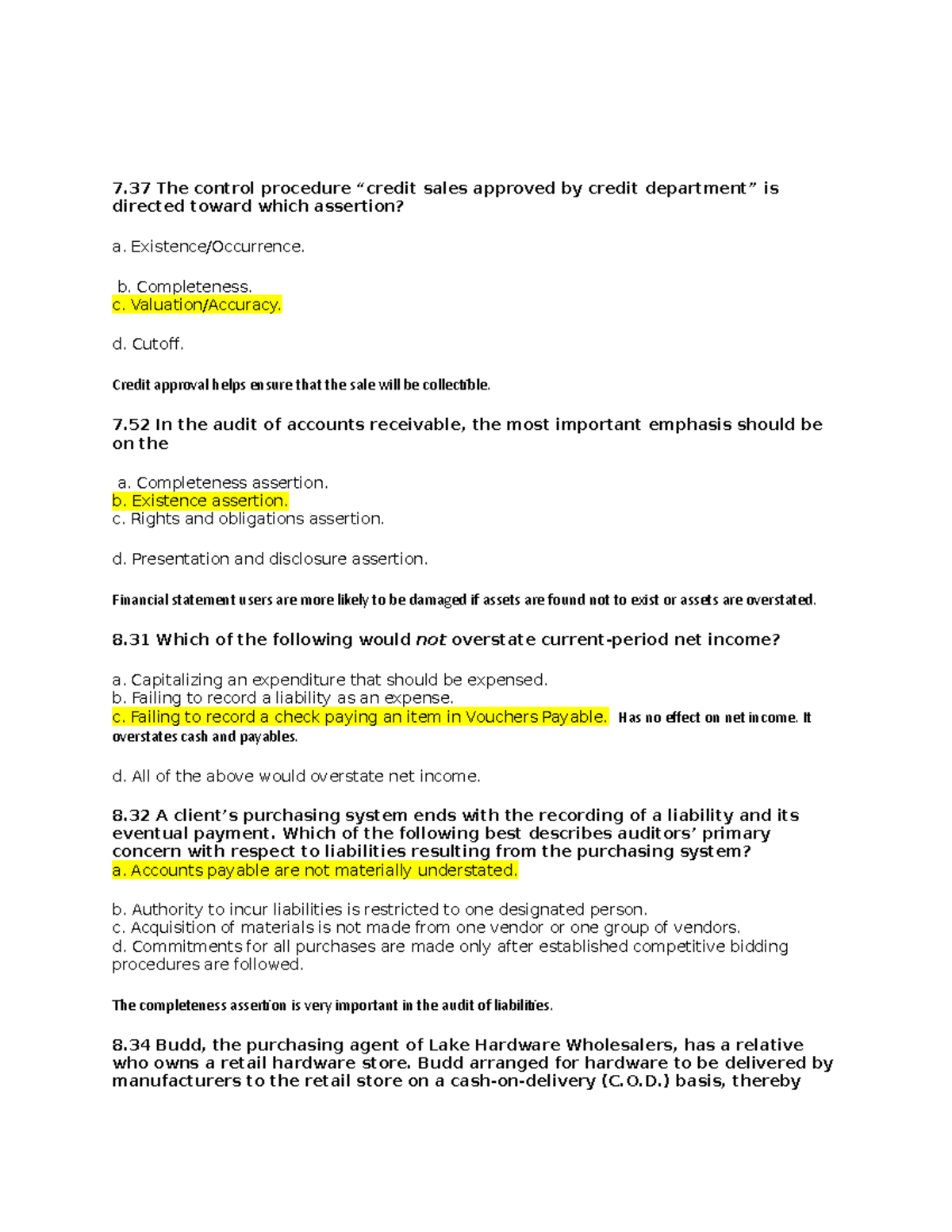

Audit Exam 2 Mc Practice Acct 40510 Notre Dame Studocu

Midterm 18 February 2019 Questions And Answers Accountancy Studocu

Comments

Post a Comment